BY ELAINE GOODMAN

Daily Post Correspondent

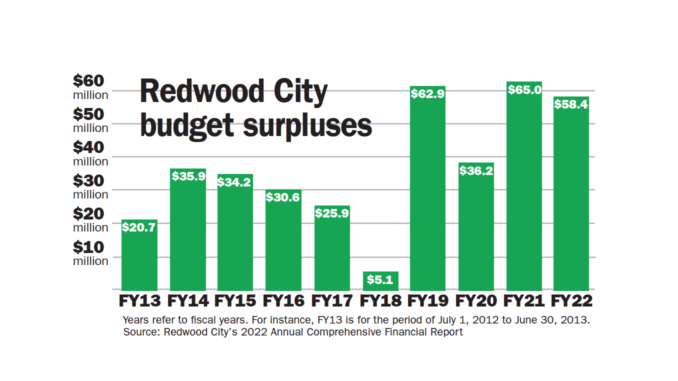

The city of Redwood City posted a budget surplus of $58.4 million for the fiscal year ending June 30, 2022 — despite the ongoing Covid-19 pandemic.

The city’s $58.4 million surplus for the 2022 fiscal year follows a $65 million surplus in fiscal year 2021, which was the largest surplus of the last 10 years. The city’s smallest surplus over the last 10 years was $5.1 million in fiscal year 2018. The surplus is what’s left after expenses for the year are subtracted from citywide revenues.

The figures are included in the city’s Annual Comprehensive Financial Report for fiscal year 2022 that was released last week. The report refers to the annual surplus as the city’s “increase in net position.”

The surplus brings the city’s net position — its total assets minus liabilities — to $629 million at the end of fiscal year 2022. That’s a 9% increase from the previous fiscal year. Of the total net position, about 87% is tied up in assets including land, buildings and equipment, the report said. The remainder of roughly $81 million includes funds that are restricted for certain purposes and funds that are unrestricted.

Revenues “recovered aggressively” during fiscal year 2022, the report said.

Property tax revenue increased to $72.4 million, up from $67.6 million in the previous fiscal year.

Sales tax revenue grew from $34.7 million in fiscal year 2021 to $36.6 million in fiscal year 2022. The 2022 figure includes $13.5 million from Measure RR, a half-cent sales tax that voters approved in 2018. It took effect in April 2019, helping to offset sales tax loss due to business closures and stay-home orders at the start of the pandemic.

Online shopping also helped, the city’s report said.

“Sales tax leapt from the depths to which it had plummeted as consumers who had gone without during the first year of the health crisis began searching for a return to normal by purchasing enhancements for a more home-centered temporary lifestyle,” the report said.

And sales tax revenue got a boost in fiscal year 2022 from the rising price of new cars, due to supply chain issues. Car sales are Redwood City’s largest single source of sales tax revenue, the report noted.

A smaller source of revenue for the city is hotel tax, also known as transient occupancy tax or TOT. Hotel tax grew to $3.3 million in fiscal year 2022, up from $1.8 million in the previous year, as hotels booked more rooms and raised rates. The city’s hotel tax revenue peaked in fiscal year 2019 at $8.6 million.

In addition to lingering impacts of the pandemic, hotel tax decreased due to the conversion of hotels to housing, the report said. San Mateo County bought two Redwood City hotels in 2020, and a third hotel in 2022, to use for affordable housing.

In other sources of revenue, Redwood City received $9.2 million in federal American Rescue Plan Act assistance in fiscal year 2021 and another $9.2 million in fiscal year 2022.

Cannabis permits brought in $227,681 in revenue for fiscal year 2022. The city expects cannabis tax revenues to grow over time.

The annual report breaks down the city’s finances into two categories: governmental and business-type activities.

Governmental activities include things like community services, police and fire, and development services. The services are largely paid for with tax revenue.

The city’s business-type activities include the water and sewer utilities, the parking fund, the Port of Redwood City, and the Docktown marina. Users pay for the services.

Governmental activities received $213 million in revenue in fiscal year 2022 and had $165 million in expenses, for a surplus of $48 million. The city transferred $3.4 million of that to its business-type activities.

The business-type activities reported $97 million in revenue and had $87 million in expenses, for a surplus of $10 million in fiscal year 2022, before the transfer of funds from governmental activities.

With surpluses like that, why would voters ever approve another tax increase?

I guess they had plenty of money to buy that expensive office furniture.

“Redwood City received $9.2 million in federal American Rescue Plan Act assistance in fiscal year 2021 and another $9.2 million in fiscal year 2022.”

That’s money you’re already paying for in the form of higher inflation, higher gas prices and higher rents. When the government just prints money out of thin air, it creates inflation. So when you go to the grocery store and get about half as much food for the same amount of money two years ago, thank those who passed American Rescue Plan, which accounts for a large part of this city’s surplus.