BY ELAINE GOODMAN

Daily Post correspondent

When the city of East Palo Alto posted an $18.8 million budget surplus for the fiscal year ending June 30, 2016, the city finance director hailed it as “good news” after many lean years in the the 1990s and 2000s.

But the hefty surplus wasn’t a fluke for East Palo Alto, which recorded a smaller but still sizable surplus of $14.8 million in the next fiscal year, ending June 30, 2017.

And cities across the region are enjoying robust surpluses, as many benefit from rising property tax revenues and new development.

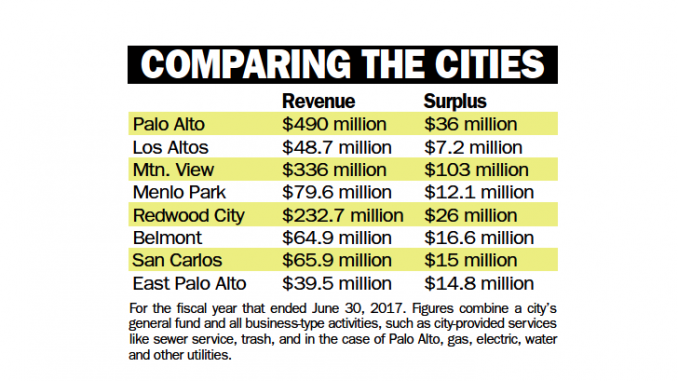

Of eight mid-Peninsula cities whose financial reports were analyzed by the Daily Post, all had surpluses for the fiscal year ending June 30, 2017, ranging from $7.2 million in Los Altos to $103 million in Mountain View.

The other cities examined were Menlo Park, with a $12.1 million surplus; San Carlos, with a $15 million surplus; and Belmont, with a $16.6 million surplus. Redwood City had a $26 million surplus for the fiscal year, while Palo Alto posted a $36 million surplus. The surpluses were calculated as the difference between a city’s revenue for the 12-month period and its expenses over the same time. The calculation included the cities’ governmental funds as well as “business-type activities,” in which users pay for a service, such as sewer service. The data are found in the comprehensive annual financial report, or CAFR, for each city.

Pressures to spend

The surging surpluses come as cities grapple with a variety of financial issues. Residents might be clamoring for new projects, such as bridges to separate Caltrain from street traffic. Employees will want pay raises. And the surpluses are a backdrop as officials eye tax increases.

Mountain View’s City Council last week decided to explore three possible tax measures for the November ballot: a marijuana sales tax, a hotel tax increase or a business tax increase.

The request came despite a 24.8% increase in the city’s governmental revenues last fiscal year, to $258.6 million. Overall revenue, including governmental and business-type revenue, was up 23%, to $336 million.

Real estate transactions change tax values

Most cities are benefiting from soaring property tax revenue.

In Redwood City, property taxes increased $4.6 million last fiscal year, mainly due to an increase in assessed valuations, the city said in its CAFR. When property is sold, it is reassessed and taxed at a rate that may be much higher than what the previous owner was paying.

“The increase in property tax revenue is attributed to the turnover of real estate properties and booming housing market,” the Redwood City report said.

Redwood City also saw an increase in community development revenues, due in part to an increase in building permits issued.

Overall, Redwood City’s surplus shrank to $26 million last fiscal year compared to $31 million in the previous fiscal year, as revenues were down just slightly and expenses were up $4.5 million.

‘An unprecedented general fund balance’

In Belmont, which posted a $16.6 million surplus last fiscal year, finances are getting a boost from Measure I, a half-cent sales tax voters approved in November 2016.

“The city has stabilized operations and reached an unprecedented general fund balance, including the effects of Measure I,” Belmont said in its CAFR. “However, the financial magnitude of the city’s aging infrastructure could threaten the city’s stability.”

Los Altos said in its CAFR that property tax, which continues to be the city’s largest single source of revenue, grew by $1.2 million last fiscal year, a 6% increase. A new hotel helped boost hotel tax revenue; on the other hand, community development fees decreased due to fewer development projects.

A factor contributing to expenses for some of the cities is their ability to fill vacant positions. Los Altos said it is working to fill positions left empty during the recession.

Vacancies reduce payroll costs

Menlo Park has beefed up staffing for development services and capital improvement projects. But despite that, the city is seeing an increase in the number of vacant positions and is having a hard time finding qualified staff, according to Menlo Park’s CAFR.

In Palo Alto, property tax revenue was up $2.8 million last fiscal year, to $39.4 million. Hotel tax increased $1.1 million, to $23.5 million. But sales tax was dropped by $100,000, to $29.9 million.