By the Daily Post staff

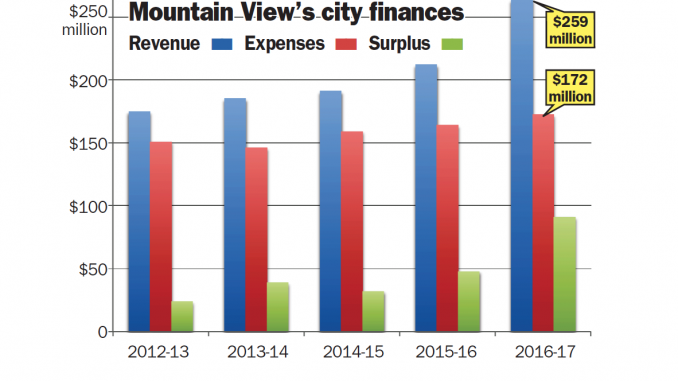

Mountain View officials tomorrow (Jan. 23) will consider three tax measures for the November ballot even though the city just completed a year in which revenues jumped by nearly 25%.

City Manager Dan Rich wants City Council to tell him if it is interested in a marijuana sales tax, an increase in the hotel tax and an increase in the business tax.

The quest for more revenue comes at a time when the city is collecting money at record levels. City revenues in the budget year ending June 30, 2017, hit $258.6 million, an increase of $51.3 million or 24.8% over the prior fiscal year, according to the city’s certified annual financial report, or CAFR.

The auditors who put together the CAFR said the city’s surplus is due to “significant increases for developer contribution fees and charges for services related to a high level of development activity.”

The CAFR went on to say, “Property taxes have also increased as property values remain strong with increases in the median price of homes, changes in ownership and new development added to the tax roll.” The CAFR, on page 3, stated that the city’s balances on June 30, 2017, were $454.1 million, and that 12.5% of that, or $57 million, is an “unassigned fund balance and is available to meet the city’s current and future needs.”

Tomorrow, council will look at how to raise even more money through new and increased taxes.

Business tax increase

A memo from Rich said the business tax could generate about $854,000 annually, more than the $250,000 currently generated. Most businesses now pay $34 a year.

Council would need to approve sending the measures to the ballot by the June 26 meeting in time for the measures to be finalized by Aug. 9.

On Dec. 5, council expressed support for making a cannabis tax and hotel tax to be general purpose measures, which would require a majority of support from voters.

The business tax could be used for transportation projects or it could simply flow into the general fund, where the proceeds could be used for everything including salaries and pensions. If the tax were earmarked for a specific purpose, it would require a two-thirds vote for passage, while a tax flowing into the general fund simply needs a majority to approve it.

The transportation revenue would likely fund the automated guideway transit, a new public transportation system that the city is considering that would cost between $50 million and $130 million per mile for the 4 to 6 miles.

The city also still has to pay to separate the Caltrain tracks from the two streets they intersect before Caltrain becomes electrified over the next few years, sending more trains down the tracks.

Separating the tracks from Castro and Rengstorff streets could cost $200 million together, though city leaders are hoping that much of that will be covered by Measure B, the 30-year, half-cent countywide sales tax for transportation projects passed in 2016.

Between the cost of a survey, hiring temporary, part-time city employees to research the measures, placing a measure on the ballot and legal consultation, the cost of putting a single measure on the ballot would be about $72,000, according to the city.