BY EMILY MIBACH

Daily Post Staff Writer

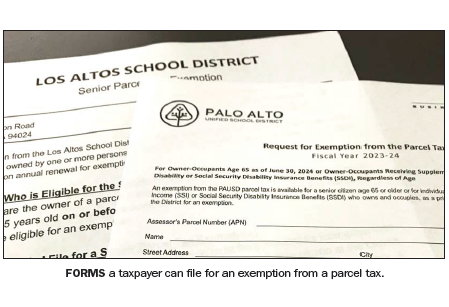

Homeowners who are over 65 have a short window to apply for exemptions from parcel taxes that show up on their property bills.

Most school districts in the area have parcel taxes, in which a flat fee is charged per parcel to support the district. In Santa Clara County, Valley Water also has a parcel tax.

Many people don’t realize that if you are over 65, or receive Social Security in some cases, you can be exempted from the tax.

The Post got some answers to questions about the exemption process.

Q: How do I sign up?

A: For most districts and Valley Water, you can either go to the district’s office and fill out the paperwork, or go online, download the application and mail it. In the case of Ravenswood School District, you need to call the number on your property bill, (866)-807- 6864, and request the application, according to an employee of Willdan, a company that administers the tax for Ravenswood.

Q: When do I need to submit my paperwork?

A: It depends on the district.

By June 1 — Menlo Park City, Las Altos school districts.

By June 15 — Belmont-Redwood Shores and Ravenswood school districts.

By June 30 — Palo Alto, Mountain View Whisman, Los Altos, Redwood City, San Carlos and Portola Valley school districts, and Valley Water.

Q: I am 68 and my spouse is 64, do we still get an exemption?

A: If you and your spouse own a home, and only one of you is 65 or older, you are still eligible for the exemption as long as you live at that home, explained Carol Paris-Brown, district office secretary for the Los Altos School District.

Q: Will my exemption roll over from year to year?

A: Each district is different. Some, such as the Redwood City School District, will check in from time to time to make sure you are still eligible for the exemption. Others may send a letter asking for a signature each year.

Q: I own a house but I rent it to somebody else. Do I get an exemption? What about commercial properties?

A: No, you only get an exemption for the property you live at. In Los Altos, if you own contiguous condo or apartment parcels, that can be exempted, Paris-Brown said. However, before applying for an exemption, check with your school district. Commercial properties don’t apply.

If you’re applying for a senior exemption, remember to vote out the officials who raised your taxes to these levels. You shouldn’t need an exemption to live here!