Opinion

BY DAVE PRICE

Daily Post Editor

Please note that this is not an editorial against the city of Palo Alto’s proposed business tax. I’ll wait to write an editorial making a recommendation either for or against it when the measure is completed. But rather this is an analysis of what council is currently considering with some suggestions about how to improve it. I’m adding this note because council members mischaracterized this column at Monday’s meeting.

It’s remarkable that Palo Alto City Council members have been talking about taxing businesses for years, and as the deadline for finalizing a ballot measure approaches, their plans are a tangled mess.

Mountain View and East Palo Alto had no problem passing business taxes because they aimed at simply the biggest businesses in town, Google and Amazon respectively.

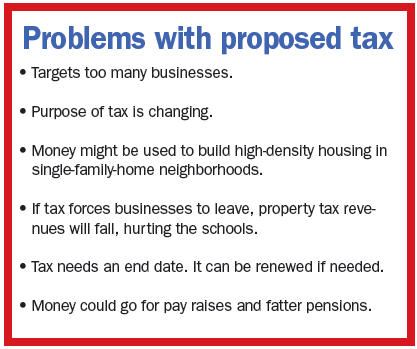

But Palo Alto council members, for whatever reason, have tentatively decided to tax 800 of the city’s 1,200 businesses. By doing this, council has created an opposition group of 800 business owners and their employees who will fight hard to stop this tax.

Mountain View and East Palo Alto didn’t have much opposition to their taxes, probably because they just targeted one or two multi-billion-dollar companies.

A second hotel tax

Not much logic has gone into this tax. For instance, why should the city slap a new tax on hotels, which already pay the city 15.5% of their gross? Mayor Pat Burt wisely said that this second tax would be too much for them. But Councilwoman Alison Cormack said she wanted the tax to be “consistent,” and didn’t like exceptions such as the one for hotels. Cormack’s thinking was arbitrary and capricious. It’s something opponents will be able to easily attack.

Not much logic has gone into this tax. For instance, why should the city slap a new tax on hotels, which already pay the city 15.5% of their gross? Mayor Pat Burt wisely said that this second tax would be too much for them. But Councilwoman Alison Cormack said she wanted the tax to be “consistent,” and didn’t like exceptions such as the one for hotels. Cormack’s thinking was arbitrary and capricious. It’s something opponents will be able to easily attack.

The fundamental problem, however, is that council doesn’t know why it wants the tax. There was talk at last Monday’s council meeting about possibly having council pass a non-binding resolution saying how they intend to spend the money.

“Non-binding” means the resolution is meaningless, just a political statement that will be forgotten when the city needs money for something that’s not on the current list.

Actually the purpose of this tax has been fuzzy for a couple of years. First it was to fund bridges over or under the Caltrain tracks (called “grade separations” in city government jargon).

The city doesn’t have a final plan for the bridges, just years of studies and reports by citizen committees. A voter will want to know what they’re buying before approving a tax increase.

We don’t know how much these grade separations will cost. With an unknown price tax, what’s to stop the city from coming back in a couple of years and asking for more money for grade separations.

Housing?

In the past two years, the purpose of the tax changed to housing. For a city that has a poor history of developing low-income housing, you’ve got to wonder if the money will ever build even one apartment, or will it just fund consultants and more city employees.

But maybe the city will decide to put up a high-density housing development like the one on Maybell Avenue that voters were forced to repeal at the ballot box in 2013? Do the neighborhood advocates want to give the city council money to build projects that

will add traffic and density to their streets? Why can’t the city promise upfront that the money won’t be used in this way?

Scare tactics

More recently, the tax is being touted as supporting “public safety,” even though the city has always been able to fund that through the regular taxes it already receives. But by making this about 911 dispatchers, police and firefighters, they’ve got material to use in mailers right before the election to scare voters into supporting the tax. The campaign committee will be able to put out a mailer warning voters that a “no” vote will affect 911 response.

If the city can engage in scare tactics, the opponents will too. They’ll point out that businesses will decide to leave the city, which will reduce the tax value of commercial buildings they abandoned and thereby lower the amount in property taxes paid. The loser is the Palo Alto Unified School District, which is funded in part by property taxes. Hard to imagine Palo Alto residents, who have consistently supported the schools at the ballot box, suddenly deciding to vote for this.

Instead of making the tax simple, the city is going forward with a taxing formula based on square footage. The only city in Santa Clara County with the same system is Cupertino, which charges 3.6 cents per square foot annually for a business between 5,000 and 25,000 square feet. Palo Alto is looking at 20 cents per square foot. I guess Apple won’t be moving any offices from Cupertino to Palo Alto if this tax goes through.

Landlords will avoid tax

This proposed square footage tax is based on some fundamental misunderstandings. Some on council think it will be paid by landlords. Yet most businesses these days have “triple net” leases where the tenant pays the property tax along with other expenses for the building like utilities and maintenance.

The tax rate is intended to rise with inflation, but that’s not a good idea at a time when inflation is at 8.5%, a 40- year high. How about capping annual increases to something reasonable?

A forever tax

The tax is also flawed because it goes on forever, unlike a school parcel tax or a bond measure, which lasts for a defined number of years. If voters don’t like how the money is spent, repealing a forever tax is next to impossible. On the other hand, a tax with a four- or five-year term forces city officials to be accountable with the money, knowing they’ll have to defend their spending at a future election.

As it stands, money from the business tax can be used for anything council wants — like higher salaries and fatter pensions. And given the behind-the-scenes control the unions have over the city government, it’s a safe bet the business tax will result in a round of pay raises for everyone at city hall before anything else gets done. Council can solve this problem by adding language to the tax that the money won’t go for pay raises and pensions.

Editor Dave Price’s column appears on Mondays. His email address is [email protected].

What an absurd way to propose a tax increase—demand the money first and then decide how it will be used. This is backward. First you present the public with the need, then you find a way to pay for it. It’s almost as if members of council hate businesses so much they want to tax them out of existence.

If they want more money for grade separations, I’d like to remind them that we passed Measure B in 2016. Bad negotiating by our local politicians meant that most of the money went for BART in San Jose, but there was supposed to be enough there to provide the local “match” for grade separations in Palo Alto, Mountain View and Sunnyvale. We taxpayers have already done our share. Quit asking us for more money!

I don’t care if this passes or not because I won’t be paying. Make the big businesses pay. The little guy pays enough already.

You missed the point that when you stick it to big businesses, the little guy ends up paying the price.

You missed the point that when you stick it to big businesses, the little guy ends up paying the price.

Singling out one business (Google or Amazon) is even worse than taxing all businesses equally from an economic and political standpoint. The few, targeted businesses cannot protect themselves politically when ganged up on – majority tyranny – and will lead to the most successful businesses leaving the area, state and/or investing more overseas in friendlier business climates. See Tesla, Palantir, Oracle, etc.

Good point and the meth addict is more honorable for spending his own money not other people’s.

The changing purpose of the tax speaks to the fact that the council simply hates business and capitalism. I’ve seen this for years. The council members pretend that the money is free and it’s theirs for the taking.

I’d like the city make some cuts before seeking a new tax. Are all of those jobs and high salaries needed? If the city manager can’t recommend cuts, bring in an expert who does this–like the private sector does. I got to believe that if the city stops wasting money, there will be money for everything important. And I’d like candidates this fall who reflect that idea instead of big spenders like Pat Burt.