BY SARA TABIN

Daily Post Staff Writer

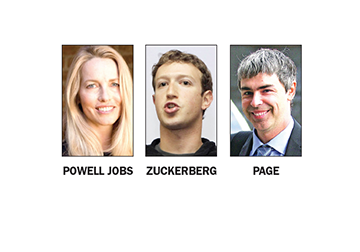

Mark Zuckerberg, Larry Page, Laurene Powell Jobs, Tim Cook and Richard Peery will have to start paying a wealth tax under a measure proposed for the November ballot in Palo Alto.

Kevin Creaven wants the city to levy a 2% tax on everyone worth more than $50 million and a 3% tax on everyone worth more than $1 billion. He wants the money to be redistributed so every resident gets $2,500.

Creaven is in the early stages of getting his initiative on the ballot. He paid for a legal notice in the Post last week that explained his measure. He said he plans to start circulating petitions to get signatures this week. He needs 2,392 valid signatures of registered Palo Alto voters, according to City Clerk Beth Minor.

An engineer by trade, Creaven moved to Palo Alto from San Diego this month for the wealth tax. He is also pushing for an increased tax on non-electric cars that cost more than $50,000.

Creaven said both taxes have been on his mind for a long time. He said the money from the wealth tax could be especially helpful amid COVID-19 shutdowns.

“When you look at history textbooks, societies with runaway wealth inequality, they start collapsing,” he said.

He said the idea has been suggested by politicians but he doesn’t expect Congress to pass a wealth tax anytime soon.

“We can take advantage of the fact that we live in a direct democracy… and do it ourselves,” he said.

Creaven said he was going to try the wealth tax in San Diego but decided it would be easier to pass in Palo Alto. He thinks it will have a meaningful impact here because of local wealth disparities.

Forbes says the billionaires who live in Palo Alto include Facebook CEO Mark Zuckerberg ($54.7 billion net worth), Google co-founder Larry Page ($50.9 billion), Steve Jobs’ widow Laurene Powell Jobs ($16.4 billion), Apple CEO Tim Cook ($1.3 billion) and developer Richard Peery ($1.1 billion).

Good luck with this. How is he going to determine everyone’s net worth? Forbes is not exactly a legal source. They will just move, in a heartbeat. But, I’ll gladly take by $2500.

Why not go further, take all the money, and distribute equally to everyone?

Oh, that’s proved not working, it’s called Communist.

Ignoring any judgment of the proposal, he doesn’t seem to have done his arithmetic.

The net worth of the 5 people listed is $125B; 3% of that is $3.75B.

Palo Alto’s estimated population is 66K. $2500 to each comes to $165M.

So what happens to the other $3.6B???

I bet most Palo Altans would not mind an extra $568,000+ in their bank account. I would apply some of my hypothetical rebate towards keeping the schools and libraries funded.

Creaven is suggesting a milder form of Elizabeth Warren’s wealth tax, and I would support trying it. Her web site (https://elizabethwarren.com/plans/ultra-millionaire-tax) notes, “the richest 130,000 families in America now hold nearly as much wealth as the bottom 117,000,000 families combined.”

What’s wrong with forcing billionaires to pay their fair share of taxes or move? If they moved, maybe house prices would come down so mere mortals could actually buy them without going into extreme debt to the banks. Why must regular folks continue to give billionaires a free ride? Are we their indentured servants?

How do you determine and verify net worth?

I bet most Palo Altans would not mind an extra $568,000+ in their bank account. I would apply some of my hypothetical rebate towards keeping the schools and libraries funded.

Creaven is suggesting a milder form of Elizabeth Warren’s wealth tax, and I would support trying it. Her web site (https://elizabethwarren.com/plans/ultra-millionaire-tax) notes, “the richest 130,000 families in America now hold nearly as much wealth as the bottom 117,000,000 families combined.”

What’s wrong with forcing billionaires to pay their fair share of taxes or move? If they moved, maybe house prices would come down so mere mortals could actually buy them without going into extreme debt to the banks. Why must regular folks continue to give billionaires a free ride? Are we their indentured servants?

Correction: $56,000+

This may seem like a fair proposal but this will cause a huge disservice to the city residents. If you pay 2% tax of your net worth you have given in 50 years 64% of your assets. Any sane billionaire would flee this city one this law is enacted and this will just add to the misery of our city. Bad idea. It is better to attract billionaires to the city and have them pay the property taxes.

Assuming that calculation is correct, it would mean a billionaire would have only $320,000,000 left in 50 years’ time. That’s still three hundred twenty million dollars in their pocket. Even assuming a robust inflation rate, someone with three hundred twenty million dollars in assets would likely still be able to afford food, shelter, investments, vacations, toys, and a generous inheritance for their heirs. Just how much money does one person need?

Palo Alto is a nice place, but not that nice. These people, who have infinite alternatives, will simply move. But we should try it and watch it fail, and then this stupid idea can be put to bed for others who are considering it in the US.

America is not a direct democracy. We don’t get what we want by mob rule, we get it with rational persuasive discussion, and elections. I question whether this would be a one-time tax, or is it yearly, based on yearly income? Surely he can’t mean that Palo Alto would take 3% of their entire worth – how can one city be entitled to that, especially when the wealth is comprised of money from all over the world? I certainly would not want it. Not because I don’t need it, but because it’s not mine. I agree with the writer above, having billionaires here opens up more possibilities, not fewer. Maybe one year we could ask the billionaires to fund a certain city-wide project or event, or our libraries for us, if the City won’t do it, and we want it. Of course, we can vote out the people making the decisions we don’t like, but that means we have to wait for the next election and hope that someone runs who will make decisions we like better! Could we ask our billionaires for more? Perhaps. Maybe they would even agree to it. Given what I know of human nature, I’m pretty sure they would more willingly contribute to the people of Palo Alto, rather than to its city government.

It’s retro-active and confiscatory. From the proposition:

“The City of Palo Alto levies an annual wealth tax on every resident in the amount of 2% on net worth above $50 million and 3% on net worth above $1 billion. This tax shall go into effect for the 2020 tax year and be due on April 15th, 2021, of the following year to the proper Tax Authority.

“A 40% exit tax or as high as legally permissible but not higher than 40%, shall be imposed on any resident with a fortune over $50 million should they relocate to a place within the United States, without an equivalent or higher wealth tax, or anywhere outside the United States.”

No thanks.

Update: Hang on just a second! I just went and read an article on Vox about this guy, and I’m alarmed! First, why does he say that we live in a “direct democracy?” We do not! So right off the bat, he’s wrong. Then, we see that he wants to imprison them here so he can keep taking their money with an “exit tax.” Finally, he just has to throw in the whole electric vs. fuel nonsense, which in my opinion is the exact wrong way to go, because of the environmental damage from lithium and cobalt mining. When I look at all of this, I have to ask, how does this man even have a PLATFORM??? Why is he not laughed out of the city?? I can’t wait to see one of his minions at my local Safeway with a petition, so that I can let him know exactly what I think of his plans to pillage Palo Alto. And as the writer above referenced, where’s the money? He wants to give each resident 2,500, and let the city have the rest of the plunder. How do you think Mountain View will feel about that? I am far from being wealthy, but I would hate to think that one little city could actually do this to anybody, because that means they could do it to me. This entire line of thinking is completely against the very idea of America, where you get to keep what you earn because it is your labor, your time, and your brains that earned that money! This is over the line, and I cannot BELIEVE that he’s actually made it this far. How has be been ALLOWED to make it this far? Who thinks like this?? I hope others join me in saying NO to this ridiculous proposal, and send it where it belongs, the trash bin.

How can I sign this petition?

There are so many problems with this proposal. Who gets to determine what a fair amount of wealth is? $20B? $20MMillion $500,000? By any national or global definition, anyone who owns a residence in PA is wealthy.

And why would all PA residents receive a re-distribution payment? Nearly everyone would cash the checks, and yet many wouldn’t need the money. Most cities would be lucky to have our wealthy people. For the most part, none of them use their wealth to exert influence in local policies or politics, as in cities like NY Chicago, and SF. Many are thought leaders in their field and enrich our culture here. Theyre the ones spending at our stores and restaurants. Many contribute generously, Some create jobs. They aren’t our real problem.