BY EMILY MIBACH

Daily Post Staff Writer

Scott Johnson, who has filed thousands of lawsuits against businesses — including many in the Palo Alto area — claiming violations of the Americans with Disabilities Act, was indicted by a federal grand jury Thursday (May 23) for tax fraud.

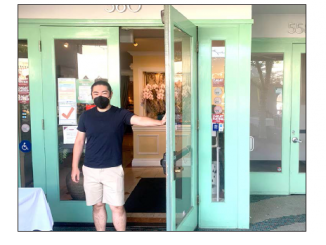

Johnson, 57, of Carmichael, has sued at least six hotels and restaurants in Palo Alto and Mountain View. His suit against Jason’s Cafe in Menlo Park — its third ADA suit — forced owner Jason Kwan to close the restaurant on April 30.

“We can’t handle it,” Kwan said after Johnson’s suit. “I’m really upset about it.”

Johnson has been filing about 44 lawsuits a month, according to attorney Rick Morin, who often defends businesses against Johnson and other ADA plaintiffs.

A federal grand jury in Sacramento on Thursday indicted Johnson on three counts of making and subscribing a false tax return. If convicted, he could face three years in prison on each of the counts.

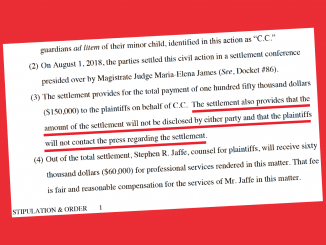

Under the law, settlements in lawsuits are taxable unless they were paid for actual physical injury or sickness. But prosecutors contend Johnson underreported the taxable income he received from lawsuit settlements and awards on his income tax returns for tax years 2012, 2013, and 2014. In fact, in 2013, he didn’t pay any federal tax at all, prosecutors said.

It’s not known how much Johnson would accept as a settlement in suits recently. But in 2006, the Sacramento Bee reported that he was receiving settlements of between $4,000 and $6,000.

Prosecutors said Johnson, who uses a wheelchair, has filed “thousands” of lawsuits.

Johnson is expected to appear in court in Sacramento for arraignment on Wednesday (May 29).