BY ELAINE GOODMAN

Daily Post Correspondent

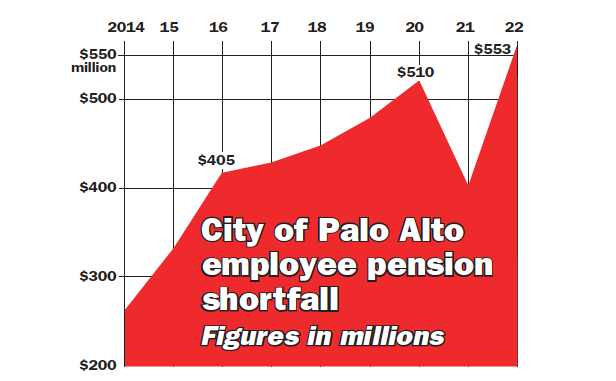

The city of Palo Alto is sinking into a deeper financial hole when it comes to employee pensions, with a pension shortfall of $553 million as of June 2022.

The city’s pension shortfall has been growing steadily for at least the last eight years, with the exception of 2021, when it temporarily shrank. In June 2014, the shortfall was $250 million. In June 2016, it was $405 million. And the June 2022 figure of $553 million is nearly $100 million more than the June 2018 shortfall of $456 million.

For comparison, the city expects to receive about $261 million in revenue this fiscal year in its general fund, which is used for day-to-day operations.

The latest pension figures are in a new report from the California Public Employees’ Retirement System, or CalPERS, which manages the city’s pension plan.

The pension shortfall is the difference between the projected cost for paying employee pensions into the future and the amount the city has in the CalPERS system. CalPERS calls the shortfall the unfunded accrued liability.

Six years ago, in September 2017, Palo Alto city council members were wringing their hands over the pension shortfall.

Council members weighed the possibility of reducing city services to pay hefty pension costs, or contracting out more work, since the city doesn’t have to pay for contractors’ pensions. Another issue was how to explain the situation to residents.

And although the city has taken some steps to try to reduce the pension shortfall – such as negotiating with unions to have workers pick up more of the pension cost – the pension gap keeps growing.

One issue is that CalPERS has made it harder for the city to pay off its pension shortfall by decreasing the rate of return it expects to receive on investments. If less is coming into the system from investment income, employers must pay more to make up the difference.

In 2017, CalPERS’ expected rate of return – which it calls the discount rate – was 7.5%. The retirement system then decided to reduce the rate to 7.0% over three years. In 2021, CalPERS again reduced the discount rate, to 6.8%.

CalPERS’ actual rate of return on investments was 21.3% for the 12 months ending June 30, 2021. But for the next 12 months, CalPERS reported an investment loss of 6.1%.

In July, CalPERS reported a preliminary net return of 5.8% on its investments for the 12 months ending on June 30, 2023.

Another way to gauge Palo Alto’s pension progress is to look at the percent of projected pension costs that the city has funded. The city’s “funded status” was 63.8% as of the fiscal year that ended June 30.

Recent projections show the city funding 90% of its pension costs for police and firefighters in fiscal year 2037. For other employees, 90% of pension costs are expected to be funded in fiscal year 2034.

Palo Alto’s pension shortfall of $553 million doesn’t factor in money the city has set aside in one of its own funds to reduce the gap. So far, the city has put $54 million into the fund. That still leaves a pension shortfall of $499 million. If money in the city’s own pension fund is included, the percent of pension costs funded increases from 63.8% to 67.3%.

The city makes two different types of payments to CalPERS each year. One payment is for pension costs for current employees. In this fiscal year, that’s expected to be about $16.5 million, according to a report to the Finance Committee.

Another payment is to whittle down the pension shortfall. This year, the amount will be around $43 million.