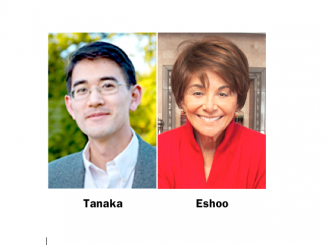

Palo Alto Congresswoman Anna Eshoo said yesterday (Dec. 19) that nearly 200,000 of her constituents will take a hit with the reduction in the deduction for state and local taxes in the new tax bill that Republicans passed in the House and Senate yesterday.

Previously, taxpayers who itemized were able to write off their state and local taxes, known as SALT. The new bill limits the deduction to $10,000.

“The bill bulldozes the state and local tax (SALT) deduction, impacting nearly 200,000 of my constituents who claimed an average deduction of $31,193 in 2015,” said Eshoo, a Democrat. “This is a critical deduction that many middle class families depend on, and by capping the SALT deduction there will be an increase of taxes for many families in my Congressional District and across California.”

Limiting the deduction to $10,000 might pressure local governments to reduce taxes, since those taxes will no longer be deductible.

“State and local governments in high-tax regions will also face immediate pressure to reduce their budgets, threatening vital services such as education, law enforcement, and public health,” Eshoo said.

Eshoo represents the

that includes Palo Alto, Menlo Park, Mountain view, Los Altos, Stanford, Atherton and parts of Redwood City. The number of constituents in Jackie Speier’s 14th Congressional District affected by the SALT reduction wasn’t immediately available. Her district spans from Redwood City to the southern portion of San Francisco.

The bill was passed by the House yesterday (Dec. 19) morning, 227-203, along party lines. Last night, the Senate narrowly passed the legislation 51-48, again along party lines.

Three provisions in the bill, including its title, violated Senate rules, forcing the Senate to vote to strip them out. So the massive bill was hauled back across the Capitol for the House to vote again on today (Dec. 20).

‘Proof will be in the paychecks’

Hours earlier, House Speaker Paul Ryan, who has worked for years toward the goal of revamping the tax code, gleefully pounded the gavel on the House vote. GOP House members roared and applauded as they passed the $1.5 trillion package that will touch every American taxpayer and every corner of the U.S. economy, providing tax cuts for businesses and individual taxpayers across the income spectrum.

About 80% of American households will get tax cuts next year, while about 5% will pay more, according to the nonpartisan Tax Policy Center.

“The proof will be in the paychecks,” Sen. Rob Portman, R-Ohio, said during the Senate’s nighttime debate. “This is real tax relief, and it’s needed.”

Critics said the bill will push the huge national debt ever higher, though Republicans point out that previous tax cuts by Presidents Reagan and Kennedy have caused government revenues to increase, offsetting the amount of the cuts.

The bill would slash the corporate income tax rate from 35% to 21%. The top tax rate for individuals would be lowered from 39.6% to 37%.

The $1,000-per-child tax credit doubles to $2,000, with up to $1,400 available in IRS refunds for families that owe little or no taxes.

No more Obamacare penalties

The legislation repeals an important part of Obamacare — the requirement that all Americans carry health insurance or face a penalty — as the GOP looks to unravel the law it failed to repeal and replace this past summer.

“This will result in an estimated 13 million people losing their health insurance and will cause premium increases for those that are insured due to a shrinking insurance pool,” Eshoo said.

While Republicans said the corporate tax cuts would result in more jobs, Democrats including Eshoo criticized the move.

“This bill is the largest corporate tax cut in our nation’s history but it compromises the future well-being of our country and its people,” she said. “Instead of reforming the tax code to expand our economy, the bill expands our debt. Instead of motivating more Americans to pursue higher education, more to own their own homes, more to move up the economic ladder, the bill sacrifices our values and vision for a plan that has never worked in the past.”