By the Daily Post staff

Some residents in San Mateo and Santa Clara counties want to pay their 2018 property taxes now before the new federal tax bill goes into effect, which will cap deductions for state and local taxes to $10,000.

But it turns out they can’t prepay those taxes.

They can pay the portion of their 2017 property tax bill that’s due April 10, 2018.

But neither county is currently accepting payments for 2018 property taxes that would normally be payable on Dec. 10, 2018 and April 10, 2019.

They’re not accepting early payments because the amounts due haven’t been finalized, according to Santa Clara County Acting Assistant Director for Tax and Collections Margaret Olaiya.

Things can change before the property tax amounts are finalized. New taxes might be approved or, if a property is sold, the tax value of the property will change. So it’s hard to know now what the final amount might be.

With the IRS, if you overpay your taxes, you can either get a refund or ask the government to keep the money “on account” so it can be used for future tax bills. But it doesn’t work that way with county governments.

No system for prepayments

Olaiya also said the county does not have the system to allow for people to prepay their taxes. This is mainly because the county keeps track of properties by parcel number and not owner name, and since properties are regularly changing hands and being worked on, there’s no real way to manage a prepaid system.

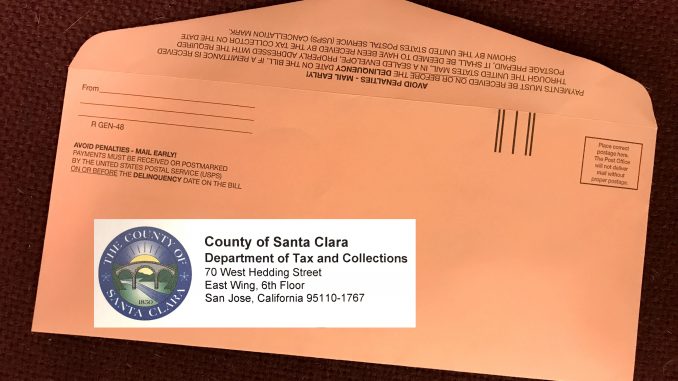

While residents can’t pay their December 2018 or April 2019 tax bills, both counties are welcoming anyone who wants to mail in their April 2018 payment now.

“Even though this is a painful process for taxpayers in the county, they can at least pay their bill up to April,” Olaiya said.

The mid-Peninsula, with residents who have higher incomes than the rest of the country, has a large number of tax filers who itemize their federal taxes and deduct state and local taxes, known as SALT.

Congresswoman Anna Eshoo, D-Palo Alto, said that nearly 200,000 of her 714,000 constituents take deductions for SALT, and the average deduction in 2015 was $31,193. –Limiting SALT to $10,000 could possibly increase taxes for many local residents.