BY EMILY MIBACH

Daily Post Staff Writer

Property taxes in San Mateo County are now due on May 4 instead of on Friday, but the county’s tax collector is urging for those who can, to pay now.

Tax Collector Sandie Arnott announced the decision today. Arnott is able to push back the county’s property tax deadline because the board of supervisors passed a resolution saying that if the tax collector’s office is closed to walk-in members of the public due to an emergency, such as the COVID-19 pandemic, then payment can be made without penalty the next day the tax collector’s office is open.

With the current stay-at-home order, the tax collector’s office will not be open until May 4, so county officials decided to push back the property tax deadline for everyone.

But since property taxes fund entities such as schools, public hospitals and county health departments, Arnott urges those who can pay their property taxes on time, to do so.

“I am very aware that many taxpayers have been individually and substantially impacted by this pandemic. I continue to work on processes to enable me to best assist you to the fullest extent the law allows should you find yourself unable to make your 2nd installment payment and are assessed with a penalty and fees,” Arnott said in a statement to taxpayers.

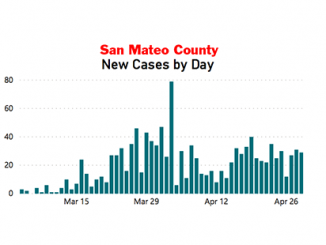

However, it is likely that payments will be coming in late.

According to a report that the county’s board of supervisors will be reviewing today, as of March 31, Arnott’s office had received $290 million, versus the usual $332 million it gets by March 31. The tax collector’s office collects $637 million to be divided up on April 15 among the county, cities, school districts and special districts.

Because it is likely that Arnott’s office will not be getting the full $637 million by April 15, her office may borrow up to $192 million from the county in order to divvy up the funds. A similar loan procedure has been used since 1993, with the largest loan from the county coming during the 2008 recession, according to the memo from County Manager Mike Callagy.

Those who cannot pay their property taxes because of financial hardships brought about by COVID-19, are asked to fill out an appeal waiver. But Arnott says she is working on ways to let her office be able to work with those who cannot pay right now.

Santa Clara County’s property taxes are still due on Friday.

San Mateo County is not the only entity pushing back tax due dates — both the state Franchise Tax Board and IRS have decided to push back the deadline for 2019 tax returns to July 15.

Regardless of when you are paying your property taxes, both counties tax collectors ask that payments be made online or through the mail, and to not wait until either of their offices are open to make payments.

If San Mateo County can do this, how come Santa Clara County’s tax collector, Larry Stone, can’t do the same thing? Time for a new tax collector in Santa Clara County, and time for a new board of supervisors. Their priority isn’t the people, it’s the county employees who want to avoid any pain while businesses are shutting down and people are being laid off.

Not surprising Larry Stone is unlike San Mateo and SF counties who are at least making some effort to help residents. Does ANYONE think Larry Stone is unbiased and fair? Stone’s annual reports consistently show over 90% positive feedback from “constituents”. I think Trump cites similar overwhelming favorable ratings.

A serious investigation is needed into Santa Clara County Assessor’s behaviors.

There was a lot of pressure put on Arnott (SM Tax Collector), for months, and she still couldn’t make the decision until yesterday. Many of her residents, paying her salary, plus Tax Payers Assoc., were giving all sorts of reasons to help them by delaying payments. She needs to be replaced also. Let her be out here with the residents and see how she likes NOT having a paycheck and being under the mandates of unreasonable government dictators.

Larry Stone is the SCC Assessor, not the county Tax Collector. The Assessor has no authority to change tax collection policy. The Tax Collector likely doesn’t either (probably falls to the Board of Supervisors), but the Tax Collector does at least have the discretion to waive the 10% late payment penalty.

Larry Stone needs to be replaced!