BY ELAINE GOODMAN

Daily Post Correspondent

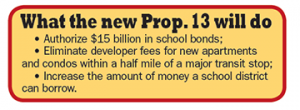

Proposition 13 on the March 3 ballot would raise $15 billion for schools across California, but it comes with a catch — school districts would lose out on developer fees for multi-family housing projects within a half mile of a major transit stop.

On a brighter note for school districts, Prop 13 would increase by 60% the limit on how much individual districts can ask for in bond measures.

But the loss of developer fees was enough for the Los Altos School District to hold off on supporting Prop 13. In addition to eliminating developer fees for multi-family housing within a half mile of a major transit stop, such as a Caltrain station, school districts’ developer fees for other multi-family housing projects would be slashed by 20%. The reductions to developer fees would stay in place until Jan. 1, 2026.

Randall Kenyon, LASD’s assistant superintendent of business services, said the Prop 13 provisions could mean the loss of revenue from projects such as a 632-unit apartment complex at 400 San Antonio Road, which is bringing in $1.2 million in developer fees. A similar housing project is in the works within district boundaries at the corner of San Antonio Road and California Street, he noted.

The LASD board on Monday (Feb. 10) discussed a possible resolution in support of Proposition 13, but decided to take no action.

“We have mixed feelings about it,” Kenyon said.

In a positive change for school districts, Proposition 13 would raise the existing cap on how much school districts can borrow through voter-approved general obligation bonds. A district’s bond-measure limit is calculated as a percentage of assessed property value within the district.

For elementary and high school districts, the limit would rise from the current 1.25% to 2% of assessed property value. For unified school districts, Prop 13 would increase the cap from the current 2.5% to 4% of assessed property value. In both cases, the cap would increase by 60%.

For elementary and high school districts, the limit would rise from the current 1.25% to 2% of assessed property value. For unified school districts, Prop 13 would increase the cap from the current 2.5% to 4% of assessed property value. In both cases, the cap would increase by 60%.

Jon Coupal, president of the Howard Jarvis Taxpayers Association, called the increase on the bond limit one of the “hidden landmines” in Proposition 13.

Although the state will repay the $15 billion bond out of its general fund, along with a projected $11 billion in interest, school districts are likely to turn to local voters with their own bond measures to generate matching funds for the state money, Coupal said on the group’s website.

Proposition would raise the debt limit

And with an increased limit on the amount school districts can borrow, “this means huge increases in property taxes are a near certainty,” Coupal said.

With local bond measures, a school district borrows money to pay for facility improvements by selling bonds; investors who bought the bonds are typically paid back through a tax increase for property owners in the district.

The Daily Post contacted nine school districts yesterday to find out how close they were to their general obligation bond borrowing limit. Only a few districts provided information.

The Menlo Park City School District has borrowed $130 million through general obligation bonds, which is 0.72% of its $18.2 billion in assessed property value. That’s a little more than halfway toward its 1.25% limit.

The Menlo Park City School District has borrowed $130 million through general obligation bonds, which is 0.72% of its $18.2 billion in assessed property value. That’s a little more than halfway toward its 1.25% limit.

In the Belmont-Redwood Shores School District, the $48 million Measure I bond measure in 2014 brought the district close to its borrowing cap, according to Superintendent Michael Milliken, who didn’t have exact figures yesterday. Voters also approved district bond measures in 2008 and 2010, Milliken said.

At the Los Altos School District, Kenyon said the district would have liked to ask voters in November 2014 for more than the $150 million included in Measure N. The district had identified about $300 million in needs at that time.

But the reason the district didn’t go for a larger bond measure wasn’t due to the cap set at 1.25% of assessed property value. Kenyon said the district still had room for more borrowing without hitting that limit.

Instead, LASD faced a different limit that kicks in when school districts float bond measures that only need 55% voter approval, rather than two-thirds. When the 55% approval threshold for some school bond measures was created through Proposition 39, a tax limit of $30 per $100,000 of assessed value was added. That’s what restricted the amount of LASD’s Measure N, Kenyon said.

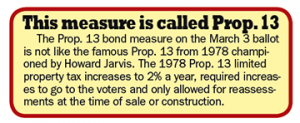

New and old Prop. 13s

Proposition 13 on the March 3 ballot isn’t related to the landmark taxpayer protection measure of 1978 that had the same name.

Of the $15 billion that would be raised by this year’s Proposition 13, $2.8 billion would go toward construction of new school facilities, $5.2 billion would be used for renovations, and $500 million each would go to charter school and career technical education facilities.

Another $6 billion would be earmarked for higher education, with $2 billion each going to community colleges, the University of California system and California State University facilities.

Thank you for this report. I almost voted for this measure.

Seems like the big developers & tech companies who were behind SB50 wrote this Prop 13. Can’t believe we haven’t heard more about this. I think development should always pay its own way.

Who is behind this Measure? Can you tell us that.

And oh, by the way, “this means huge increases in property taxes are a near certainty,” Coupal said.

Developer and union construction workers give away. Forget it! No on so called prop 13.