BY SARA TABIN

Daily Post Staff Writer

The Santa Clara County Supervisors agreed yesterday to waive late fees for property taxpayers, but they waited until after the tax deadline to try to get as many people as possible to pay up.

The supervisors unanimously agreed to waive the 10% penalty and $20 fee for people who paid their April 10 taxes late. They made the move in response to the economic fallout from the COVID-19 stay-at-home order, which has cost residents their jobs and forced local employers to close permanently.

Supervisor Mike Wasserman said he assumes more people already paid their taxes because they knew they were due and didn’t know the fees would be waived. But Wasserman said he was concerned that letting people not pay on time could have future repercussions for the county since other revenue sources, such as the sales tax, will likely fall.

Supervisor Joe Simitian of Palo Alto, who proposed the idea of waiving late fees with Board President Cindy Chavez, said that the move wasn’t intended to defer people’s obligation to pay taxes, which was why the proposal came after the deadline passed.

Simitian previously told the Post that he thinks the proposal struck a good balance between helping people and protecting county funds. He said he didn’t want to discourage people from paying on time, he just doesn’t want the county to punish people who weren’t able to pay.

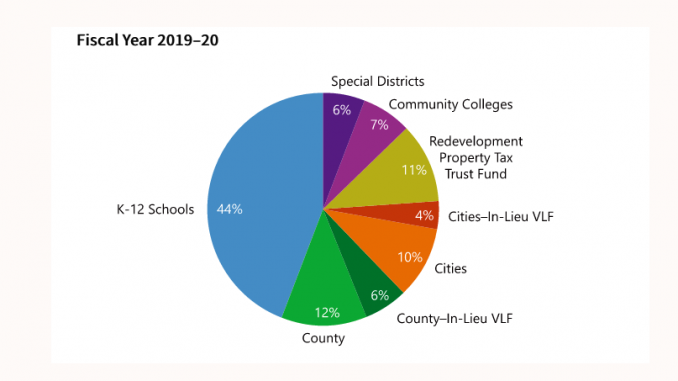

He said the county government doesn’t keep most of the property tax dollars. He said most of it goes to other agencies such as schools, community colleges and cities.

In Palo Alto, for instance, 44% of the money paid by a property taxpayer goes to the Palo Alto Unified School District, 12% goes to Santa Clara County and 7% to the Foothill-De Anza Community College District.

Simitian said that collecting property taxes ensures every level of government is running at a time when people need more government services.